What You Need to Know About IRS Wait Times

If you need something from the Internal Revenue Service (IRS), don’t expect to get it right away. In

2021 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of

Is an LLC the right choice for your small business?

Perhaps you operate your small business as a sole proprietorship and want to form a limited liability company

Auditing WIP

Many types of businesses — such as homebuilders and manufacturers — turn raw materials into finished products for

Accounting methods: Private companies have options

Businesses need financial information that’s accurate, relevant and timely. The Securities and Exchange Commission requires publicly traded companies

Internal control questionnaires: How to see the complete picture

Businesses rely on internal controls to help ensure the accuracy and integrity of their financial statements, as well

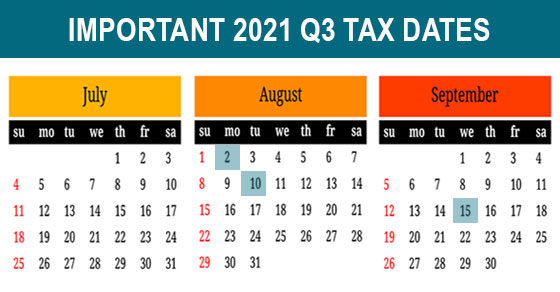

2021 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of

10 facts about the pass-through deduction for qualified business income

Are you eligible to take the deduction for qualified business income (QBI)? Here are 10 facts about this

Accounting methods: Private companies have options

Businesses need financial information that’s accurate, relevant and timely. The Securities and Exchange Commission requires publicly traded companies

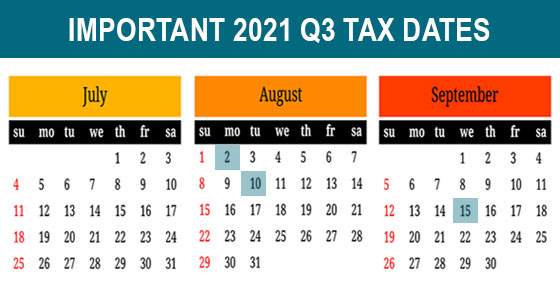

2021 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of

How to strengthen your internal controls

Internal controls are a system of policies and procedures organizations put in place to protect assets and improve

Using your financial statements to evaluate capital budgeting decisions

Strategic investments — such as expanding a plant, purchasing a major piece of equipment or introducing a new

Help ensure the IRS doesn’t reclassify independent contractors as employees

Many businesses use independent contractors to help keep their costs down. If you’re among them, make sure that

The Restaurant Revitalization Fund is now live

The COVID-19 pandemic has affected various industries in very different ways. Widespread lockdowns and discouraged movement have led

Financial keys to securing a commercial loan

Does your business need a loan? Before contacting your bank, it’s important to gather all relevant financial information

Making cents of your statement of cash flows

The statement of cash flows essentially tells you about cash entering and leaving a business. It’s arguably the

Keep it in the Family

As a business owner, you should be aware that you can save family income and payroll taxes by

EIDL loans, restaurant grants offer relief to struggling small businesses

The American Rescue Plan Act (ARPA), signed into law in early March, aims at offering widespread financial relief

Footnote disclosures: The story behind the numbers

The footnotes to your company’s financial statements give investors and lenders insight into account balances, accounting practices and

Business highlights in the new American Rescue Plan Act

President Biden signed the $1.9 trillion American Rescue Plan Act (ARPA) on March 11. While the new law